How Illinois’ cannabis taxes are spent

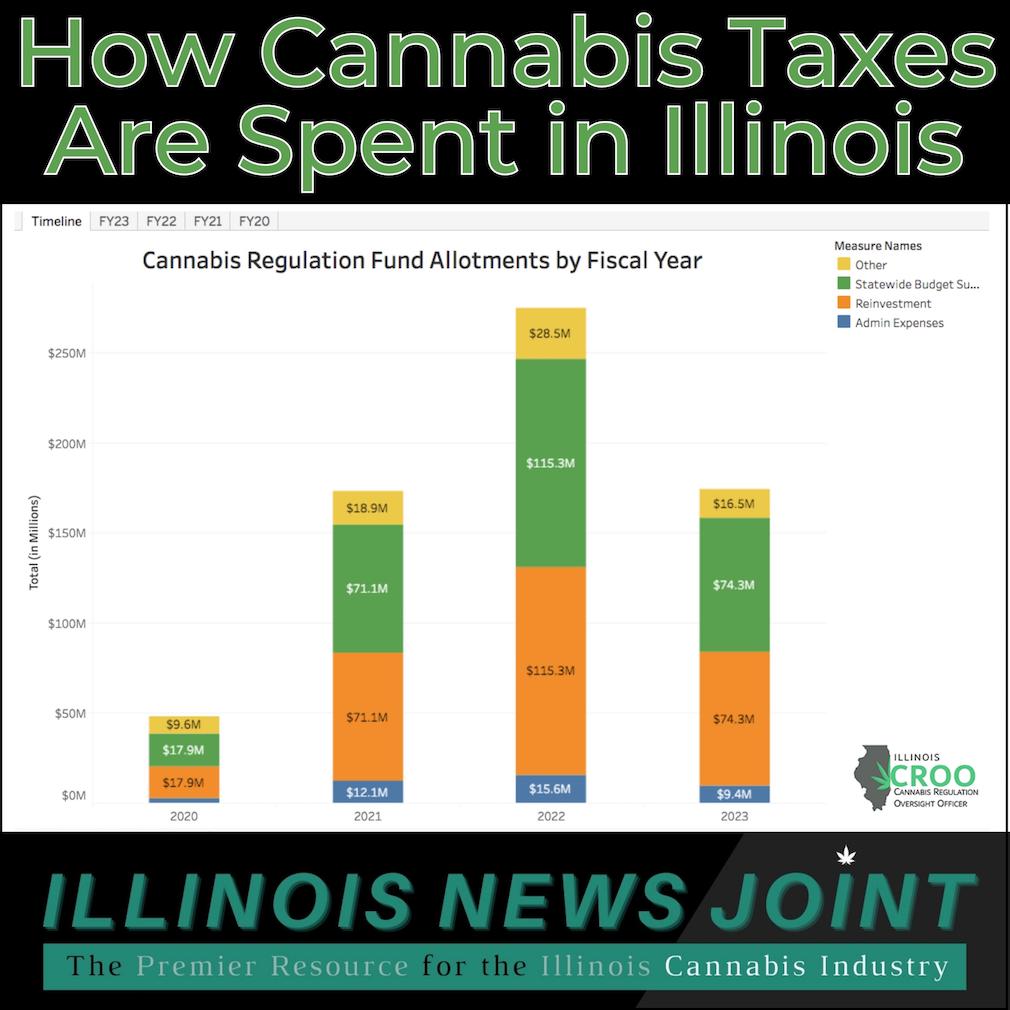

One of the comments we get most, especially after publishing monthly cannabis sales totals, is, “Where’s all that tax money going?” or “Why aren’t our potholes fixed?” or some version of that sentiment. Recently, the Cannabis Regulation Oversight Office (CROO), which coordinates among all agencies involved in the direct regulation and taxation of Illinois’ cannabis industry, launched a new website that gives a breakdown on how cannabis tax dollars are spent in Illinois.

According to the CROO website, the Illinois Department of Revenue posts monthly updates how the Cannabis Regulation Fund gets distributed. Taxes from adult use cannabis sales, including wholesale taxes and retail taxes at dispensaries, get collected into the Cannabis Regulation Fund, which are then distributed by statute and spent by the fiscal year budget.

First, the money flows to administrative expenses by the State agencies implementing cannabis.

Administrative Expenditures:

– Department of Financial and Professional Regulation

– Department of Agriculture

– Illinois State Police

– Department of Public Health

– Department of Revenue

– Criminal Justice Information Authority

– Department of Commerce and Economic Opportunity

Second, a portion of the funds are available for expungement processing. Finally, the remaining funds get transferred out to other State funds. The State funds include:

Reinvestment:

– Restore Reinvest Renew (R3) grant funds

– Department of Human Services’ Community Services fund

Statewide Budget Support:

– Budget Stabilization Fund

– General Revenue Fund

Other Distributions:

– Cannabis Expungement Fund

– Local Government Distributive Fund

– Department of Human Services’ Drug Treatment and Education fund

– Other funds

Note that distributions are not the budget allocations or agency expenditures but instead the statutory transfers from the Cannabis Regulation Fund. Below is Section 6z-112 of the State Finance Act that governs the distributions of the Cannabis Regulation Fund. For more Illinois cannabis industry news, visit here.

To find more cannabis-friendly events in Illinois, visit here.

For Illinois News Joint reviews, visit here.

To qualify and receive a medical patient card at a discounted rate, visit here.

Section 6z-112 of the State Finance Act governs the distributions of the Cannabis Regulation Fund

30 ILCS 105/6z-112

(a) There is created the Cannabis Regulation Fund in the State treasury, subject to appropriations unless otherwise provided in this Section. All moneys collected under the Cannabis Regulation and Tax Act shall be deposited into the Cannabis Regulation Fund, consisting of taxes, license fees, other fees, and any other amounts required to be deposited or transferred into the Fund.

(b) Whenever the Department of Revenue determines that a refund should be made under the Cannabis Regulation and Tax Act to a claimant, the Department of Revenue shall submit a voucher for payment to the State Comptroller, who shall cause the order to be drawn for the amount specified and to the person named in the notification from the Department of Revenue. This subsection (b) shall constitute an irrevocable and continuing appropriation of all amounts necessary for the payment of refunds out of the Fund as authorized under this subsection (b).

(c) On or before the 25th day of each calendar month, the Department of Revenue shall prepare and certify to the State Comptroller the transfer and allocations of stated sums of money from the Cannabis Regulation Fund to other named funds in the State treasury. The amount subject to transfer shall be the amount of the taxes, license fees, other fees, and any other amounts paid into the Fund during the second preceding calendar month, minus the refunds made under subsection (b) during the second preceding calendar month by the Department. The transfers shall be certified as follows:

(1) The Department of Revenue shall first determine, the allocations which shall remain in the Cannabis Regulation Fund, subject to appropriations, to pay for the direct and indirect costs associated with the implementation, administration, and enforcement of the Cannabis Regulation and Tax Act by the Department of Revenue, the Department of State Police, the Department of Financial and Professional Regulation, the Department of Agriculture, the Department of Public Health, the Department of Commerce and Economic Opportunity, and the Illinois Criminal Justice Information Authority.

(2) After the allocations have been made as provided, in paragraph (1) of this subsection (c), of the remainder of the amount subject to transfer for the month as determined in this subsection (c), the Department shall certify the transfer into the Cannabis Expungement Fund 1/12 of the fiscal year amount appropriated from the Cannabis Expungement Fund for payment of costs incurred by State courts, the Attorney General, State’s Attorneys, civil legal aid, as defined by Section 15 of the Public Interest Attorney Assistance Act, and the Department of State Police to facilitate petitions for expungement of Minor Cannabis Offenses pursuant to Public Act 101-27, as adjusted by any supplemental appropriation, plus cumulative deficiencies in such transfers for prior months.

(3) After the allocations have been made as provided, in paragraphs (1) and (2) of this subsection (c), the Department of Revenue shall certify to the State Comptroller and the State Treasurer shall transfer the amounts that the Department of Revenue determines shall be transferred into the following named funds according to the following:

(A) 2% shall be transferred to the Drug Treatment Fund to be used by the Department of Human Services for: (i) developing and administering a scientifically and medically accurate public education campaign educating youth and adults about the health and safety risks of alcohol, tobacco, illegal drug use (including prescription drugs), and cannabis, including use by pregnant women; and (ii) data collection and analysis of the public health impacts of legalizing the recreational use of cannabis. Expenditures for these purposes shall be subject to appropriations.

(B) 8% shall be transferred to the Local Government Distributive Fund and allocated as provided in Section 2 of the State Revenue Sharing Act. The moneys shall be used to fund crime prevention programs, training, and interdiction efforts, including detection, enforcement, and prevention efforts, relating to the illegal cannabis market and driving under the influence of cannabis.

(C) 25% shall be transferred to the Criminal Justice Information Projects Fund to be used for the purposes of the Restore, Reinvest, and Renew Program to address economic development, violence prevention services, re-entry services, youth development, and civil legal aid, as defined by Section 15 of the Public Interest Attorney Assistance Act. The Restore, Reinvest, and Renew Program shall address these issues through targeted investments and intervention programs and promotion of an employment infrastructure and capacity building related to the social determinants of health in impacted community areas. Expenditures for these purposes shall be subject to appropriations.

(D) 20% shall be transferred to the Department of Human Services Community Services Fund, to be used to address substance abuse and prevention and mental health concerns, including treatment, education, and prevention to address the negative impacts of substance abuse and mental health issues, including concentrated poverty, violence, and the historical overuse of criminal justice responses in certain communities, on the individual, family, and community, including federal, State, and local governments, health care institutions and providers, and correctional facilities. Expenditures for these purposes shall be subject to appropriations.

(E) 10% shall be transferred to the Budget Stabilization Fund.

(F) 35%, or any remaining balance, shall be transferred to the General Revenue Fund.

As soon as may be practical, but no later than 10 days after receipt, by the State Comptroller of the transfer certification provided for in this subsection (c) to be given to the State Comptroller by the Department of Revenue, the State Comptroller shall direct and the State Treasurer shall transfer the respective amounts in accordance with the directions contained in such certification.

(d) On July 1, 2019 the Department of Revenue shall certify to the State Comptroller and the State Treasurer shall transfer $5,000,000 from the Compassionate Use of Medical Cannabis Fund to the Cannabis Regulation Fund.

(e) Notwithstanding any other law to the contrary and except as otherwise provided in this Section, this Fund is not subject to sweeps, administrative charge-backs, or any other fiscal or budgetary maneuver that would in any way transfer any amounts from this Fund into any other fund of the State.

(f) The Cannabis Regulation Fund shall retain a balance of $1,000,000 for the purposes of administrative costs.

(g) In Fiscal Year 2024 the allocations in subsection (c) of this Section shall be reviewed and adjusted if the General Assembly finds there is a greater need for funding for a specific purpose in the State as it relates to Public Act 101-27.

(Source: P.A. 101-27, eff. 6-25-19; 102-558, eff. 8-20-21.)